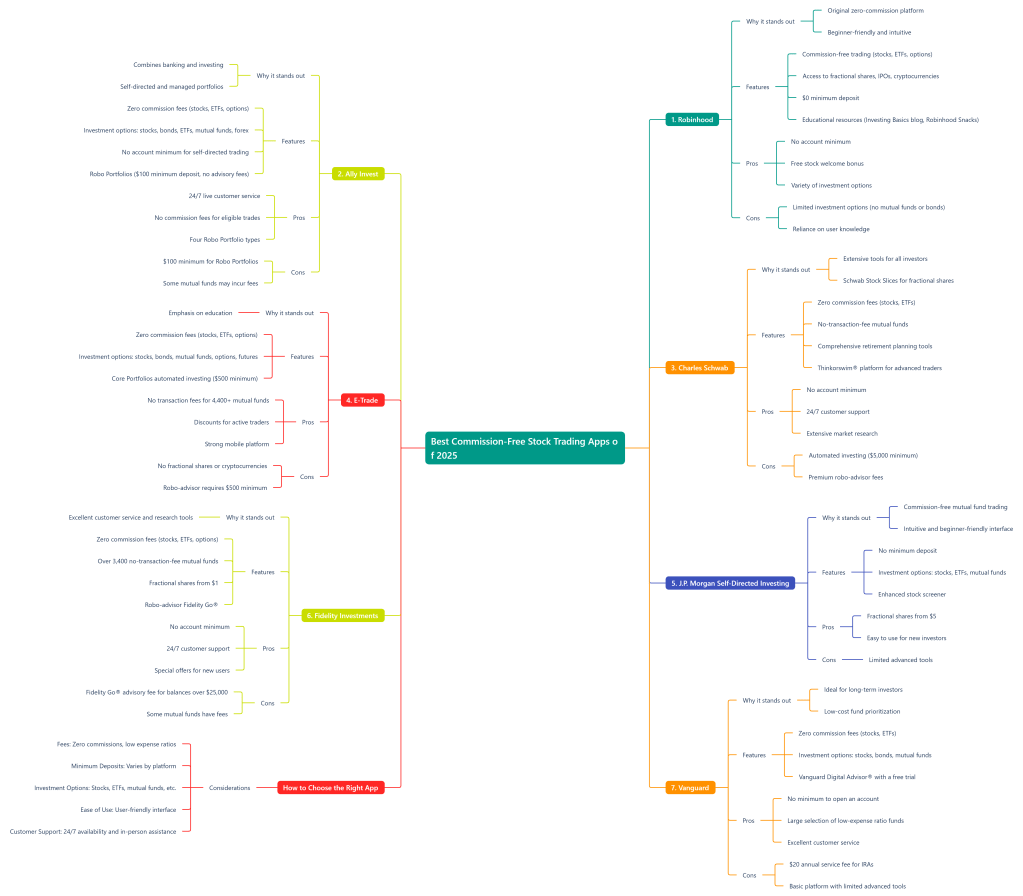

The following platforms have been recognized as the best commission-free stock trading apps of 2025. Each caters to different types of investors, offering unique features, investment opportunities, and tools to suit various needs.

1. Robinhood

Why it stands out: Robinhood is one of the original zero-commission trading platforms, designed for streamlined and beginner-friendly trading. The app is intuitive and easy to use, making it ideal for new investors or those who want a no-fuss experience.

Features:

- Commission-free trading for stocks, ETFs, and options.

- Access to fractional shares, IPOs, and cryptocurrencies (availability depends on location).

- $0 minimum deposit to open an account or start investing.

- Educational resources such as the “Investing Basics” blog and the Robinhood Snacks newsletter.

Pros: - No account minimum required.

- Free stock welcome bonus for new users.

- Variety of investment options for active traders.

Cons: - Limited investment options (e.g., no mutual funds or bonds).

- Users must rely on their own knowledge when building portfolios.

2. Ally Invest

Why it stands out: Ally Invest is perfect for those looking to combine banking and investing seamlessly. It offers both self-directed trading and managed portfolios, making it suitable for both hands-on investors and those who prefer automation.

Features:

- Zero commission fees for stock, ETF, and options trades.

- Investment options include stocks, bonds, ETFs, options, mutual funds, margin accounts, and forex trading.

- No account minimum for self-directed trading.

- Robo Portfolios (managed portfolios) with a $100 minimum deposit and no advisory fees.

- Informational articles and calculators to help users improve their understanding of investment strategies.

Pros: - 24/7 live customer service with brokers.

- No commission fees for eligible trades.

- Robo Portfolios available with four portfolio types to choose from.

Cons: - Robo Portfolios require a $100 minimum deposit.

- Some mutual funds may require transaction fees.

3. Charles Schwab

Why it stands out: Charles Schwab is known for its extensive offerings and tools for both novice and experienced investors. Its fractional share program, “Schwab Stock Slices,” allows investors to buy portions of S&P 500 companies for as little as $5.

Features:

- Zero commission fees for stock and ETF trades.

- No-transaction-fee mutual funds available.

- Access to stocks, bonds, mutual funds, CDs, and ETFs.

- Comprehensive retirement planning tools and personalized portfolio-building features.

- Award-winning thinkorswim® trading platforms for advanced traders.

Pros: - No account minimum for active investing.

- 24/7 customer support and over 300 physical branches for in-person assistance.

- Extensive market research and real-time news from sources like Morningstar and Credit Suisse.

Cons: - Automated investing requires a $5,000 minimum deposit.

- Premium robo-advisor services come with additional fees.

4. E-Trade

Why it stands out: E-Trade is a strong choice for investors who value education. It provides a wide range of online resources, including retirement and tax-planning guides, market analysis, and on-demand webinars.

Features:

- Zero commission fees for stock, ETF, and options trades.

- Investment options include stocks, bonds, mutual funds, CDs, ETFs, options, and futures.

- Automated investing through Core Portfolios with a $500 minimum deposit and a 0.30% annual advisory fee.

- Power E-Trade platform for advanced analysis and trading tools.

Pros: - No transaction fees for over 4,400 mutual funds.

- Discounts for active traders on options contracts.

- Strong mobile platform with customizable watchlists.

Cons: - No fractional shares or cryptocurrency options.

- Robo-advisor Core Portfolios requires a $500 minimum deposit.

5. J.P. Morgan Self-Directed Investing

Why it stands out: This platform is one of the few that offers commission-free online mutual fund trading, making it a great option for investors who prioritize mutual funds. It also has an intuitive interface that’s beginner-friendly.

Features:

- No minimum deposit or balance required.

- Investment options include stocks, ETFs, mutual funds, options, and fixed-income products.

- Enhanced stock screener to filter investments by criteria like sector and market cap.

Pros: - Fractional shares available for as little as $5.

- Easy-to-use platform for new investors.

Cons: - Limited advanced tools for experienced traders.

6. Fidelity Investments

Why it stands out: Fidelity is renowned for its excellent customer service and comprehensive research tools. It caters to both beginners and experienced investors with its wide range of offerings.

Features:

- Zero commission fees for stock, ETF, and options trades.

- Access to over 3,400 mutual funds with no transaction fees.

- Fractional shares available for as little as $1.

- Robo-advisor Fidelity Go® with no advisory fees for balances under $25,000.

- Educational tools and research from over 20 independent providers.

Pros: - No account minimum required.

- 24/7 customer support and over 100 physical branches for in-person assistance.

- Special offers and promotions for new users.

Cons: - Fidelity Go® charges a 0.35% advisory fee for balances over $25,000.

- Some mutual funds have specific thresholds or fees.

7. Vanguard

Why it stands out: Vanguard is ideal for long-term investors who prioritize low-cost funds and straightforward investing. It automatically invests unutilized funds into a money market fund, providing better returns than competitors’ default options.

Features:

- Zero commission fees for stock and ETF trades.

- Investment options include stocks, bonds, mutual funds, CDs, ETFs, and options.

- Robo-advisor Vanguard Digital Advisor® with a 90-day free trial.

- Retirement planning tools and access to Vanguard Personal Advisor Services® for personalized guidance.

Pros: - No minimum to open an account.

- Large selection of ETFs and mutual funds with low expense ratios.

- Excellent customer service and human-to-human support.

Cons: - $20 annual service fee for IRAs and brokerage accounts (waivable with paperless statements).

- Basic trading platform with limited advanced tools.

How to Choose the Right App

When selecting a commission free stock trading platform/app, consider the following factors:

- Fees: Look for platforms with zero commissions and low expense ratios.

- Minimum Deposits: Some platforms require no minimum, while others may require a deposit for specific services.

- Investment Options: Ensure the app offers the types of investments you’re interested in, such as stocks, ETFs, mutual funds, or cryptocurrencies.

- Ease of Use: Choose an app with a user-friendly interface that matches your level of experience.

- Customer Support: Platforms with 24/7 support or in-person branches can be helpful.

These commission free trading apps cater to a wide range of investors, from beginners to seasoned traders, ensuring there’s an option for everyone. Let me know if you’d like more details about any specific platform!

Leave a comment