In the dynamic world of cryptocurrency, staking has emerged as a popular method for earning passive income. Unlike traditional fixed-income assets, crypto staking allows you to lock up your digital tokens in a blockchain network to earn rewards, often in the form of additional tokens. This practice not only helps you grow your investment but also contributes to the security and efficiency of the blockchain network.

This article will delve into the best cryptocurrency exchanges for staking in 2025, providing a detailed evaluation of each platform based on metrics such as yields, lock-up terms, supported tokens, regulatory compliance, and customer service. Whether you’re a seasoned investor or a beginner, this guide will help you navigate the complex landscape of crypto staking and choose the platform that best suits your needs.

What is Crypto Staking?

Crypto staking is the process of locking up your digital tokens for a set period to support the operations of a blockchain network. In exchange, you earn rewards, typically expressed as an annual percentage yield (APY). These rewards are generated through the validation of transactions and the creation of new blocks, which are essential functions in proof-of-stake (PoS) and delegated proof-of-stake (DPoS) blockchains.

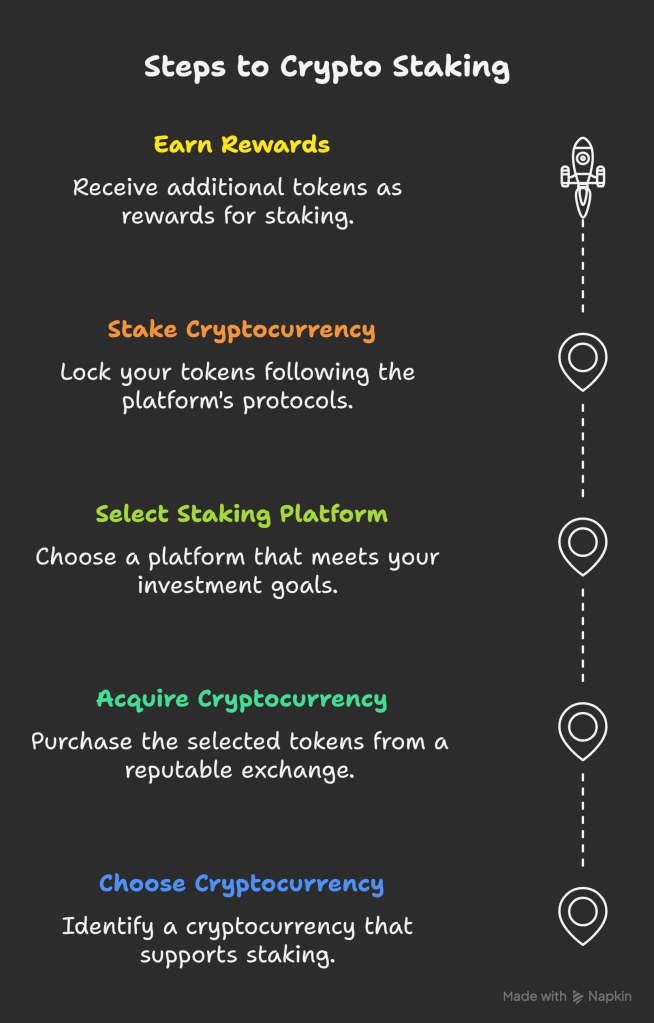

How Does Crypto Staking Work?

- Choose a Cryptocurrency: Not all cryptocurrencies support staking. Focus on those that use PoS or DPoS consensus mechanisms.

- Acquire the Cryptocurrency: Purchase your chosen tokens through a reputable cryptocurrency exchange.

- Select a Staking Platform: Choose a platform that aligns with your investment goals and offers the desired APY.

- Stake Your Cryptocurrency: Follow the platform’s protocols to lock your tokens for a predefined period.

- Earn Rewards: Receive additional tokens as rewards for your contribution to the network.

Example of Crypto Staking

Suppose a blockchain network offers a 5% APY for a staking period of one month. You decide to stake 100 tokens. After a month, you receive 5 additional tokens as your reward. This simple example illustrates the basic mechanism of crypto staking.

What is a Crypto-Staking APY?

The Annual Percentage Yield (APY) for cryptocurrency staking refers to the compounded yearly return on your staked tokens. Unlike the Annual Percentage Rate (APR), which does not account for compounding, APY includes the interest earned on your initial investment as well as the interest earned on subsequent interest payments. This makes APY a more accurate measure of potential earnings over a year.

Importance of APY

- Compound Interest: APY accounts for the reinvestment of rewards, leading to exponential growth.

- Comparison Tool: Helps investors compare different staking opportunities across platforms and cryptocurrencies.

- Transparency: Provides a clear understanding of the potential returns, allowing for informed decision-making.

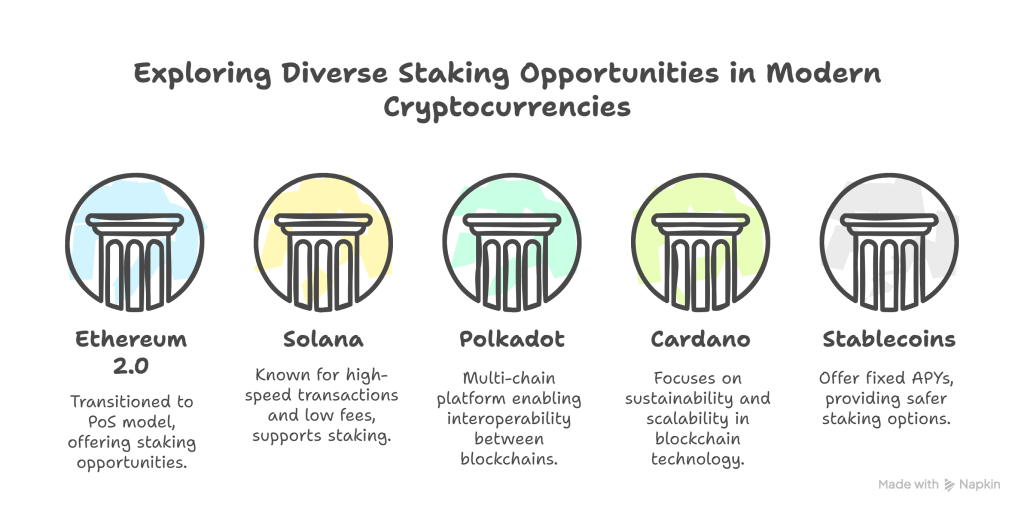

What Coins Can I Stake?

Not all cryptocurrencies support staking. Only those that use the PoS or DPoS consensus algorithms offer staking options. Here are some popular staking coins:

- Ethereum (ETH): Ethereum 2.0 transitioned to a PoS model, offering staking opportunities.

- Solana (SOL): Known for its high-speed transactions and low fees, Solana supports staking.

- Polkadot (DOT): A multi-chain platform that allows for interoperability between different blockchains.

- Cardano (ADA): A third-generation blockchain platform focused on sustainability and scalability.

- Algorand (ALGO): Designed for high transaction speeds and low energy consumption.

- Cosmos (ATOM): Supports interoperability and allows for the creation of custom blockchains.

- Tether (USDT) and USD Coin (USDC): Stablecoins that offer fixed APYs, providing a safer staking option.

Best Crypto Staking Platforms – Cryptonic’s 2025 Top 5 Suggested!

1. ByBit

ByBit is a leading cryptocurrency exchange that offers flexible staking options, making it an ideal choice for investors who are looking of fixed-term crypto staking platforms. The platform supports a wide range of top coins, including Bitcoin (BTC), Ethereum (ETH), USDT, Bit, Solana (SOL), and Polkadot (DOT).

Features

- Flexible Staking: Offers both short-term and long-term staking options, allowing you to adjust your investment strategy.

- High APYs: Competitive annual percentage yields, with some coins offering up to 14% APY.

- User-Friendly Interface: Easy to navigate, making it accessible for both beginners and experienced investors.

- Security Measures: ByBit holds a regulatory license and employs robust security protocols to protect user funds.

Drawbacks

- Manual Reinvestment: Compound staking is not automated, requiring manual reinvestment for continuous earnings.

- Limited Coin Selection: While it supports many popular coins, the selection is not as extensive as some other platforms.

ByBit’s flexible staking options and competitive APYs make it a strong contender for those looking to earn passive income without committing to long lock-up periods. However, the lack of compound staking automation and a slightly limited coin selection are factors to consider.

2. Binance

Binance is one of the largest and most reputable cryptocurrency exchanges globally. It offers a diverse array of staking coins, making it a top choice for investors seeking high returns. Binance supports nearly 100 different staking coins, each with varying APYs and lock-up terms.

Features

- Diverse Coin Selection: Supports a wide range of cryptocurrencies, including BTC, ETH, USDT, USDC, Binance Coin (BNB), Solana (SOL), and more.

- High APYs: Some coins offer APYs as high as 30%, making it an attractive option for high-yield seekers.

- Multiple Lock-Up Terms: Offers staking periods of 10, 30, 60, or 90 days, providing flexibility.

- Regulatory Compliance: Holds multiple regulatory licenses, ensuring a safe and compliant environment.

- Customer Support: Offers extensive customer service options, including live chat and detailed guides.

Drawbacks

- Complex User Interface: May be overwhelming for beginners.

- Higher Minimum Investments: Some staking pools require higher minimum investments.

Binance’s extensive coin selection and high APYs make it an excellent choice for experienced investors looking to maximize their returns. However, beginners may find the platform’s complexity and higher minimum investments challenging.

3. Coinbase

Coinbase is a user-friendly and regulated cryptocurrency exchange that offers staking services alongside its trading platform. It is particularly suitable for beginners due to its simplicity and security measures.

Features

- Regulated Environment: Holds regulatory licenses in multiple jurisdictions, ensuring a secure investment.

- User-Friendly: Simple and intuitive interface, making it easy for beginners to navigate.

- Stable APYs: Offers consistent APYs, with rates ranging from 0.15% to 5%.

- Supported Coins: Supports six staking coins, including Ethereum (ETH), Algorand (ALGO), Cosmos (ATOM), Tezos (XTZ), Dai (DAI), and USD Coin (USDC).

Drawbacks

- Limited Coin Selection: Supports fewer staking coins compared to Binance and ByBit.

- Lower APYs: APYs are generally lower than those offered by other platforms.

Coinbase’s regulated environment and user-friendly interface make it an excellent choice for beginners. However, the limited coin selection and lower APYs may not appeal to more experienced or high-yield-seeking investors.

4. Crypto.com

Crypto.com is a top-tier cryptocurrency exchange known for its high APYs and user-friendly design. It offers staking options for both stablecoins and other cryptocurrencies, making it a versatile platform.

Features

- High APYs: Offers annual returns of up to 14% for stablecoins and higher for other cryptocurrencies.

- Daily, Weekly, and Monthly Rewards: Provides frequent reward payouts, enhancing the potential for compound earnings.

- Individual and Pool Staking: Allows users to stake individually or join staking pools for better returns.

- Mobile App: Offers a mobile app for convenient management of staking activities.

- Flexibility: Supports both flexible and long-term staking options.

Drawbacks

- Moderate Coin Selection: While it supports a variety of coins, the selection is not as extensive as Binance.

- Manual Reinvestment: Requires manual reinvestment for continuous earnings

Crypto.com’s high APYs and frequent reward payouts make it a compelling choice for investors looking to earn significant returns. The mobile app and flexible staking options add convenience, but the moderate coin selection and need for manual reinvestment are considerations.

5. Kraken

Kraken is a well-established cryptocurrency exchange known for its robust security measures and staking capabilities. It supports staking for 12 different crypto assets and offers both on-chain and off-chain staking options.

Features

- Robust Security: Known for its strong security measures and regulatory compliance.

- Unstaking Flexibility: Allows unstaking for most crypto assets, eliminating the need for a bonding period.

- Frequent Rewards: Pays staking rewards once or twice a week, depending on the coin.

- No Staking Fees: Does not charge fees for staking or unstaking.

- Supported Coins: Includes Ethereum (ETH), Solana (SOL), Polkadot (DOT), and others.

Drawbacks

- Moderate APYs: APYs are generally moderate compared to some other platforms.

- Complex Setup: May require more technical knowledge for optimal use.

Kraken’s strong security and unstaking flexibility make it a reliable choice for investors. The frequent reward payouts and no staking fees are additional advantages. However, the moderate APYs and slightly more complex setup may not be ideal for everyone.

Where to Stake Crypto with the Highest APY

Choosing the best platform for staking your cryptocurrency depends on your investment goals and the type of coin you want to stake. Below is a comparison of APYs for various cryptocurrencies across different platforms.

| Platform | Tether (USDT) | USD Coin (USDC) | Ethereum 2.0 (ET H) | Binance Coin (BNB) | Solana (SOL) | Cardano (ADA) | Cosmos (ATOM) | Tezos (XTZ) | Polkadot (DOT) | Algorand (ALGO) |

|---|---|---|---|---|---|---|---|---|---|---|

| Binance | 10.00% | N/A | 5.20% | 10.00% | 1.50% – 14.79% | 2.00% – 15.79% | 1.42% – 30.49% | 2.00% – 8.67% | 3.00% – 20.98% | 1.00% – 8.24% |

| ByBit | 4.25% | 5.50% | 1.75% | N/A | 0.58% | 0.55% | 1.10% | N/A | 1.32% | 5% – 10% |

| Huobi Global | Up to 20% APY | Up to 20% APY | Up to 20% APY | Up to 20% APY | Up to 20% APY | Up to 20% APY | Up to 20% APY | Up to 20% APY | Up to 20% APY | Up to 20% APY |

| OKEx | 10.00% | 12.00% | 4.07% | N/A | 12% | 5% | N/A | N/A | N/A | N/A |

| Crypto.com | 6.5% | 6.5% | 4% | 3% | 4.5% | 3% | 5% | N/A | 12.5% | 3% |

Key Considerations

- Investment Goals: Determine whether you prioritize high APYs, flexibility, or security.

- Coin Selection: Choose a platform that supports the cryptocurrencies you are interested in.

- Lock-Up Periods: Consider the minimum staking periods and whether they align with your investment horizon.

- Regulatory Compliance: Ensure the platform operates within legal frameworks to protect your investments.

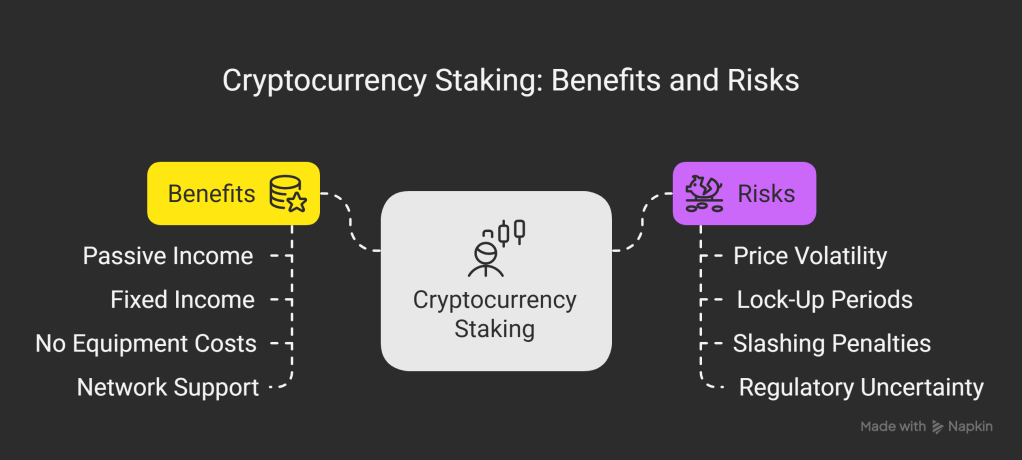

Is Crypto Staking a Good Idea?

Yes, crypto staking can be an excellent way to grow your cryptocurrency investments. Here are some key points to consider:

Benefits

- Passive Income: Earn rewards without active trading.

- Fixed Income: Know in advance the amount of income you will earn.

- No Equipment Costs: Unlike mining, staking does not require expensive hardware.

- Network Support: Contribute to the security and efficiency of the blockchain network.

Risks

- Price Volatility: Cryptocurrency values can fluctuate, affecting the overall value of your staked tokens.

- Lock-Up Periods: Funds are locked for a set period, limiting liquidity.

- Slashing Penalties: Validators can lose staked tokens for violating network protocols.

- Regulatory Uncertainty: The lack of clear regulations can pose legal risks.

What is the Minimum Staking Period?

The minimum staking period is the shortest duration for which your tokens must be locked to earn rewards. Typically, the minimum staking period is 24 hours (one day). However, some platforms may offer shorter or longer periods depending on the coin and the staking program.

How to Stake Crypto

Follow these step-by-step instructions to start staking your cryptocurrency:

Step 1: Choose a Cryptocurrency Exchange

- Research: Evaluate different exchanges based on their reputation, security, and supported cryptocurrencies.

- Reputation: Opt for well-known and trusted platforms.

Step 2: Sign Up for an Account

- Personal Information: Provide your personal details and verify your identity.

- Security: Ensure the platform has robust security measures in place.

Step 3: Deposit Fiat Money

- Payment Methods: Use bank transfers, credit/debit cards, or other supported methods to fund your account.

Step 4: Buy Your Chosen Cryptocurrency

- Research: Thoroughly research the cryptocurrencies you are interested in staking.

- Purchase: Place a buy order for your chosen tokens through the exchange.

Step 5: Join a Staking Pool

- Staking Pools: Most exchanges use staking pools to enhance the chances of earning rewards.

- Selection: Research the available staking pools and choose one that aligns with your goals.

Step 6: Stake Your Cryptocurrency

- Lock-Up: Lock your tokens for the specified period.

- Monitor: Keep track of your staking rewards and manage your investments accordingly.

Best Coins to Stake in 2025

1. Tether (USDT)

- Overview: Tether is a stablecoin pegged to the US dollar, offering stability in a volatile market.

- APY: Up to 6.5% on platforms like Crypto.com.

- Advantages: Low risk due to its stable value, making it ideal for risk-averse investors.

- Disadvantages: Lower APYs compared to other cryptocurrencies.

2. Polkadot (DOT)

- Overview: Polkadot is a multi-chain platform that facilitates interoperability between different blockchains.

- APY: 11.5% – 16.5% on platforms like ByBit and Huobi Global.

- Advantages: High APYs and a growing ecosystem.

- Disadvantages: Moderate risk due to market volatility.

3. Cardano (ADA)

- Overview: Cardano is a third-generation blockchain platform focused on sustainability and scalability.

- APY: 5% – 8.5% on platforms like ByBit and Huobi Global.

- Advantages: Strong community support and potential for future growth.

- Disadvantages: Lower APYs compared to high-yield coins.

4. Tron (TRON)

- Overview: Tron is a distributed network for the free exchange of content and the development of entertainment applications.

- APY: 5.5% – 8% on platforms like ByBit and Huobi Global.

- Advantages: Growing user base and diverse applications.

- Disadvantages: Limited adoption compared to larger cryptocurrencies.

5. Binance Coin (BNB)

- Overview: Binance Coin is the native token of the Binance ecosystem, used for various services within the platform.

- APY: 6% – 9% on platforms like Binance and Huobi Global.

- Advantages: High liquidity and a wide range of use cases within the Binance ecosystem.

- Disadvantages: Higher minimum investment requirements.

Cryptocurrency Mining vs. Staking

Proof-of-Work (PoW) Consensus Algorithm

- Mechanism: Miners solve complex mathematical problems to validate transactions and create new blocks.

- Equipment: Requires specialized hardware like ASICs or GPUs.

- Costs: High electricity and maintenance costs.

- Rewards: Distributed among miners based on computational power.

Proof-of-Stake (PoS) Consensus Algorithm

- Mechanism: Validators are chosen based on the number of tokens they hold and are willing to lock up.

- Equipment: No specialized hardware required.

- Costs: Minimal operational costs.

- Rewards: Distributed based on the amount of staked tokens.

Comparative Table

| Criteria | Staking | Mining |

|---|---|---|

| Minimum Investment | Depends on the exchange/wallet and the cryptocurrency selected. For many cryptocurrencies, it is enough to deposit $10-50. | Depends on the cost of the equipment. Can be from $1-2 thousand and higher. |

| Associated Costs | No additional costs (e.g., electricity, farming supplies). | High electricity costs and maintenance costs for hardware. |

| Profit Margins | From 1-2% to 120% per annum, depending on the cryptocurrency and platform. | Depends on the market value of the mined cryptocurrency. Payback of the farm is 6-12 months. |

| Opportunity to Earn Without Additional Equipment | Yes, no specialized hardware required. | No, requires specialized hardware like ASICs or GPUs. |

| Technical Knowledge | Minimal technical knowledge required. | High technical knowledge required for setting up and maintaining mining equipment. |

| Risk of Hardware Failure | Low, as no hardware is required. | High, hardware can fail, leading to downtime and potential loss of income. |

| Environmental Impact | Low, as it does not require significant energy consumption. | High, due to the high energy consumption of mining equipment. |

| Flexibility | Flexible staking options available, including short-term and long-term staking. | Fixed, as mining requires continuous operation of hardware. |

| Regulatory Compliance | Generally more compliant, as it does not involve the same level of energy consumption and hardware. | Regulatory scrutiny can be higher due to the environmental impact and energy consumption. |

Conclusion

Crypto staking has emerged as a popular and efficient way to earn passive income in the cryptocurrency market. By locking up your digital tokens in a blockchain network, you not only earn rewards but also contribute to the security and efficiency of the network. The best crypto staking platforms in 2025, such as ByBit, Binance, Coinbase, Crypto.com, and Kraken, offer a range of features and benefits to suit different investment goals and risk tolerances.

Key Takeaways

- ByBit: Offers flexible staking options and competitive APYs, making it suitable for investors wary of fixed-term staking.

- Binance: Supports a wide range of staking coins and offers high APYs, ideal for experienced investors seeking high returns.

- Coinbase: Provides a user-friendly and regulated environment, perfect for beginners.

- Crypto.com: Offers high APYs and frequent reward payouts, making it a compelling choice for high-yield seekers.

- Kraken: Known for its robust security and unstaking flexibility, suitable for investors looking for a reliable platform.

Final Thoughts

When choosing a crypto staking platform, consider your investment goals, the type of coins you want to stake, the lock-up periods, and the APYs offered. Ensure the platform is regulated and has robust security measures in place to protect your investments. Whether you are a beginner or an experienced investor, crypto staking can be a valuable addition to your investment portfolio, providing a steady stream of passive income and contributing to the growth and stability of the blockchain ecosystem.

By following the steps outlined in this guide and staying informed about the latest developments in the crypto market, you can make informed decisions and maximize your returns from crypto staking in 2025 and beyond.

I hope this comprehensive guide on the best crypto staking platforms in 2025 is helpful and informative. If you have any specific questions or need further details, feel free to ask!

Leave a comment